When concluding a purchase and sale transaction or a service agreement, often the shipment of products or the beginning of contract work occurs without prepayment. A deferred payment is provided to the customer on the basis of a business letter containing financial obligations to pay the received values within the agreed time frame. Such a letter refers to a guarantee letter and is, in fact, a credit form confirming the borrower's intention to pay the formed debt.

Instructions

Step 1

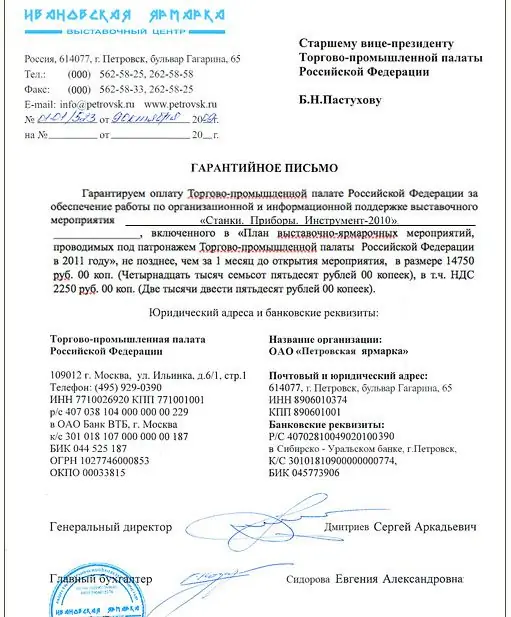

Make a letter of guarantee on letterhead or place a corner stamp with the filled in company details (name, form of ownership, bank details and actual address). Register the letter as an outbound document. In the upper right corner, indicate the addressee's details (full name of the organization, position and full name of the head).

The letter may contain a request for the supply or performance of services and guarantee their timely payment. In this case, it will begin with the words "Please execute" and the last paragraph will say "We guarantee payment". For a letter containing only a guarantee of payment, the beginning will be "Guarantee payment".

Step 2

Next, list the goods or services that became the subject for the conclusion of a bilateral agreement. Indicate the amount of the transaction in figures and words, as well as the terms of payment of the indicated amounts. At the end of the document, be sure to indicate the full name, bank details for transfers and legal addresses of each of the parties.

Submit the letter to your supervisor for signature. In some cases, they also sign with the chief accountant. Seal their signatures.