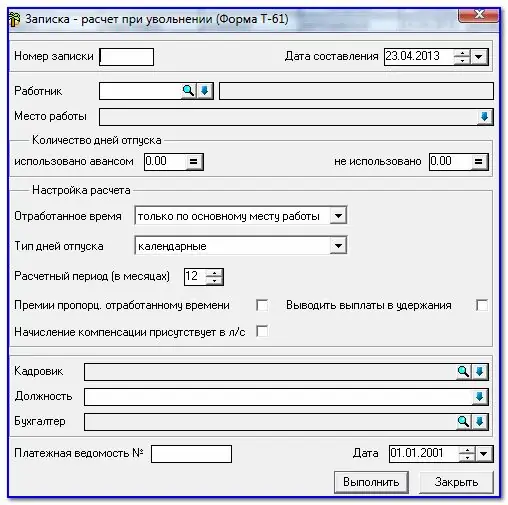

On the last day of work of a retiring employee, the organization is obliged to calculate all payments due to him and issue the amount due. Calculation of payments is made according to the unified form No. E-61 "Note-calculation upon termination of an employment contract with an employee."

It is necessary

- - calculator,

- - computer,

- - data on wages.

Instructions

Step 1

Calculate the employee's salary for the last days worked by him in the month preceding the dismissal.

Step 2

Enter the calculated amount of wages, the regional coefficient and the regional percentage allowance in the section "Notes-calculations", which is called "Calculation of payments", in columns 10 and 11, respectively.

Step 3

Calculate the compensation for the employee's unused vacation. To do this, you need to calculate the number of days for which payments are due. Calculate using the formula: 36 days / 12 months. x C = T, where C is the number of days since the last vacation, T is the number of days for which compensation is due.

Step 4

Calculation of daily earnings is made according to the formula: A / 12 months / 29, 4 days = B; where A is the amount of accrued wages for the last 12 months, B is the average daily earnings.

Step 5

Make the final calculation of compensation according to the formula: T x B = I, where T is the number of days for which the compensation is due, B is the average daily earnings, And is the total amount of compensation.

Step 6

Enter the received data in the section "Notes - calculations", which is called "Calculation of payment for vacation" and fill in all the relevant columns from the first to the ninth.

Step 7

Enter the amount of vacation pay in column 12 and summarize in the section called "Calculation of payments". To do this, calculate the following indicators: column 10 + column 11 + column 12 = column 13.

Step 8

Calculate the amount of personal income tax (13%) on the accrued amount of payments and enter this indicator in column 14. If this indicator came out with kopecks, round up to the nearest whole number.

Step 9

Fill in the indicator for other deductions, the organization's debt to the employee, as well as the employee's debt to the organization (Columns 17, 18). If the indicators are zero, put a dash.

Step 10

Calculate the total amount payable. In column 19 = column 13 - column 16 = total.

Step 11

Fill in the details of the accountant, put your signature and date.