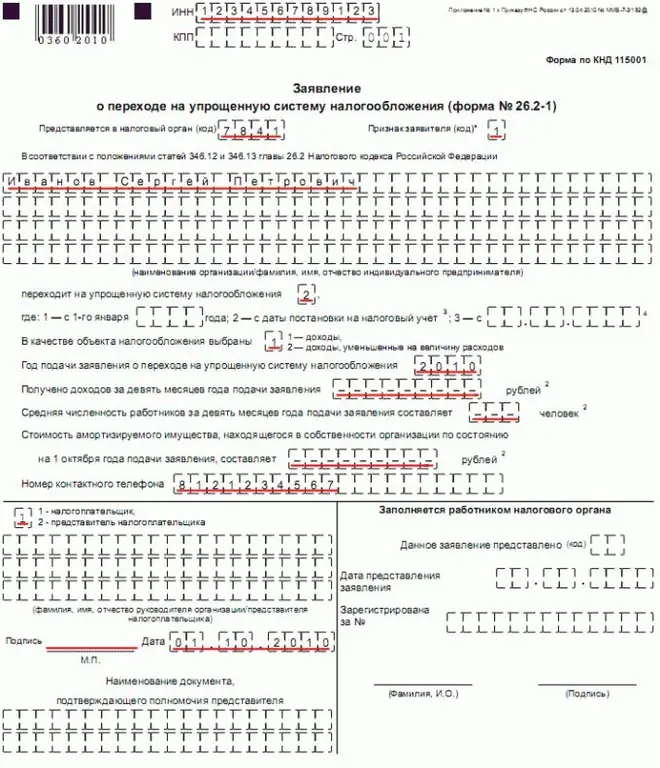

You need to fill out an application for the transition to the simplified taxation system (simplified taxation system) from October 1 to November 30 of the year preceding the transition to the simplified taxation system. A newly created organization or a newly registered entrepreneur can apply for the transition to the simplified taxation system within five days from the date of registration, or write this application simultaneously with the application for registration.

Necessary

- -computer and printer;

- - internet connection.

Instructions

Step 1

Download the application form for the transition to the simplified taxation system, form No. 26.2-1с of the official website of the Federal Tax Service (the form is posted in pdf format), or from another site in a format that is more convenient for you, while making sure that the submitted form is not outdated.

Step 2

Indicate in the field at the top of the form your TIN and KPP, provided that you are already in business and have decided to switch to the simplified taxation system next year, or submit an application within five days after registration. Organizations and individuals who submit this application simultaneously with the registration application do not need to fill in these fields.

Step 3

Enter in the appropriate fields the code of the tax authority to which you are applying, as well as the number corresponding to your characteristic of the applicant: • when submitting an application along with the registration documents, the number "1" is put;

• when submitting an application within five days from the date of registration - the number "2";

• when switching from another taxation system - the number "3".

Step 4

Enter your full name, or the name of the organization in the appropriate field.

Step 5

Put the number corresponding to the date of transition, and also write in the very date from which you are switching to the simplified taxation system: • when switching from a taxation system other than UTII, put the number "1" (ie from January 1 of the next year);

• if you have just registered - the number "2" (ie from the date of tax registration);

• when switching from UTII - the number "3" (ie from the 1st day of the next month).

Step 6

Select the object of taxation (income - the number "1", or income minus expenses - the number "2").

Step 7

Indicate the year of application.

Step 8

Fill in the following fields if you are already in business and decide to switch to the simplified taxation system from another taxation system. Newly registered persons and organizations do not need to fill in these items.

Step 9

Enter your contact phone number.

Step 10

Fill in all the data in the columns at the bottom left of the form in accordance with your status: entrepreneurs put the number "1", representatives of the organization - the number "2", and also indicate your full name (and the name of the head - for organizations), sign and date and enter the name document confirming your authority (if you are a representative of the organization).

Step 11

Put dashes in all the boxes that you do not need to fill out. Submit your completed application to your tax authority on time.