Sooner or later, things at the enterprise fall into disrepair, they have to be written off. It's just that the thing on the balance sheet of the enterprise cannot be thrown out in any case, you should draw up an act of write-off. Correct record keeping will avoid problems with inventory.

Necessary

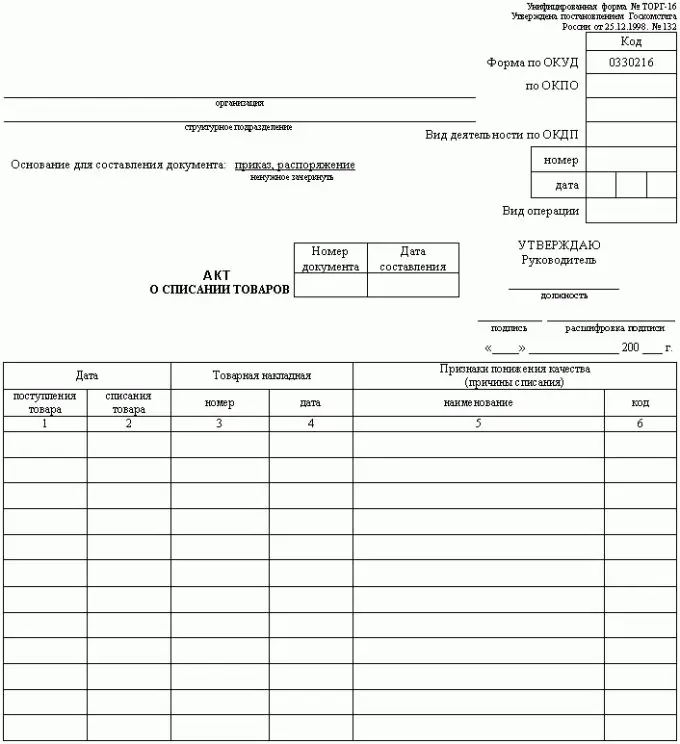

The write-off requires a printout of the write-off certificate in two copies. In addition, it is necessary to collect a commission of at least three people

Instructions

Step 1

Write in the debit certificate form the values that are to be written off. If reporting allows, several points can be specified in one act at once.

Step 2

Fill in the "initial cost" column. In order for the figure to be accurate, it must be found in the book of accounting of values, by the date of acceptance of the value on the balance sheet. Also, the price indicated after the revaluation of the cost (in case the fixed assets of the enterprise are subject to write-off), the so-called replacement cost, can also be indicated here.

Step 3

Fill in the column "Amount of accrued depreciation (depreciation)". Here you must indicate the amount of depreciation since commissioning, plus the cost of writing off objects, and the amount of the value of material assets that you may have received when disassembling the decommissioned equipment.

Step 4

Enter the data on the results of the write-off in the inventory book and the book of material assets. This must be done immediately at the time of the write-off, in order to avoid confusion in the future.

Step 5

Let the commission sign both copies of the write-off certificate and hand over one of them to the accounting department. The second copy must be in the possession of the person responsible for the material value. Since you are filling out the write-off act, then most likely it is with you.