The Tax Code does not contain an obligation for the taxpayer to register the ledger of income and expenses with the tax authority. However, such a duty is provided for in the Procedure for Keeping a Book, and if the taxpayer does not want to prove in court later that he had such a book at all, it is better for him to follow this simple procedure.

Necessary

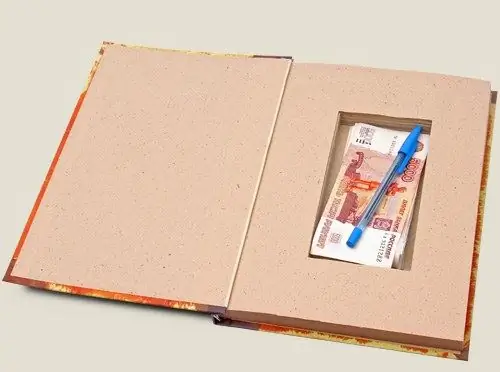

The book of income and expenses for the current tax period

Instructions

Step 1

The book of income and expenses, which is mandatory for organizations and entrepreneurs under the simplified taxation system, can be kept both in paper and in electronic form. In both cases, it must be registered (certified) with the tax authority. The certification procedure consists in the fact that the official of the tax inspectorate puts a signature and seal on it, as well as the date of certification. The basis for registering the book is the appeal of the taxpayer.

Step 2

The representative of the organization / entrepreneur must bring the book in person and be present during the certification. You cannot send it by mail, especially by e-mail.

Step 3

If the ledger of income and expenses is kept in paper form, then it is drawn up properly and registered even before the start of its maintenance. If you keep a book in electronic form, then after the end of the tax period (that is, the calendar year) you must print it, and then perform all the manipulations provided for by the Procedure for maintaining a book for its paper version (lace, number, certify with the signature of the head and seal and etc.), and assured by the tax authority. The deadline for submitting the book for certification in this case is set the same as for filing a tax return, that is, no later than March 31 of the year following the expired tax period for payer organizations and no later than April 30 for individual entrepreneurs.

Step 4

The representative of the tax authority is obliged to certify the book of income and expenses on the same day when you asked him for this.

Step 5

Even if your book is "zero", that is, there are no entries in it due to your lack of activity in the reporting year, you still have to register it. And you must assure her.