When buying (building) residential real estate (apartments, houses, rooms), a citizen has the right to provide a property tax deduction. This means that the state will return you part of the money spent by refunding personal income tax (PIT) or will not withhold this tax from you within a certain amount.

Necessary

- To receive a property deduction at the end of the year, you must submit to the tax office at your place of residence:

- A completed tax return in the form of 3 personal income tax.

- Application for the return of personal income tax in connection with the cost of acquiring property, indicating the details for transferring the refund amounts.

- A certificate from the accounting department at the place of work on the amounts of accrued and withheld taxes for the corresponding year in the form 2-NDFL.

- Copies of documents confirming the right to housing (certificate of state registration of law, agreement on the purchase of housing, act of transfer of the apartment, credit agreement or loan agreement, mortgage agreement, etc.).

- Copies of payment documents confirming expenses for the acquisition of property (receipts for credit orders, bank statements on the transfer of funds from the buyer's account to the seller's account, sales and cash receipts and other documents).

- Documents confirming the payment of interest under a target loan agreement or loan agreement, mortgage agreement (extracts from personal accounts, bank statements on interest paid for using a loan).

- A copy of the marriage certificate (if the housing is acquired in joint ownership).

- Application for the distribution of the property tax deduction (if the housing is acquired in joint ownership).

Instructions

Step 1

Download from the website of the tax office and install the program for filling out the declaration for the year you need.

Step 2

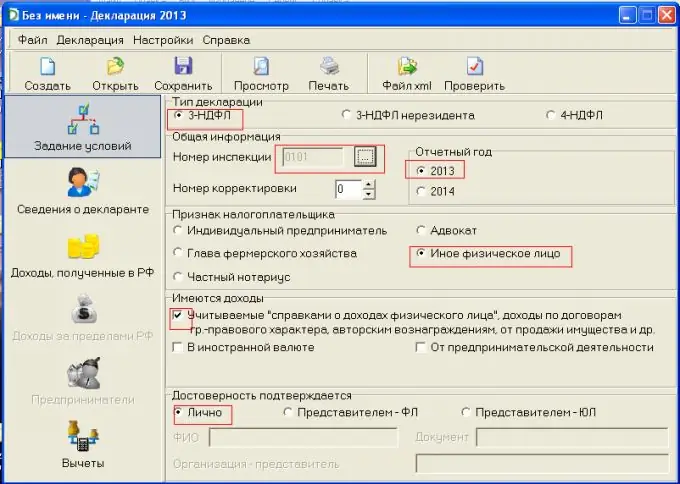

Open the program. The program opens on the "Specify conditions" tab. We fill in: type of declaration, inspection number (selection from the list), reporting year, taxpayer sign, available income, confirmation of authenticity.

Step 3

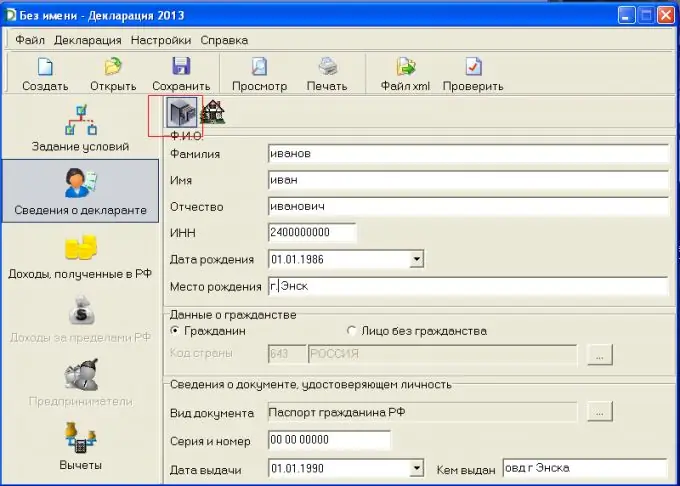

Go to the tab "Information about the declarant". We fill in personal data.

Step 4

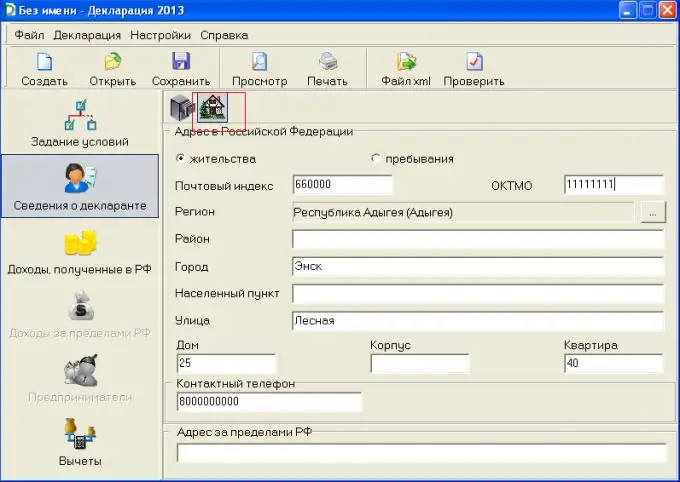

Click on the "house" picture. We proceed to filling in the address (according to the passport). In 2013, the indicator "OKATO Code" was replaced by "OKTMO Code". On the website of the Federal Tax Service of Russia there is an electronic service "Know OKTMO". It allows you to determine the OKTMO code by the OKATO code, by the name of the municipality, as well as using the data from the Federal Information Address System (FIAS) reference book.

Step 5

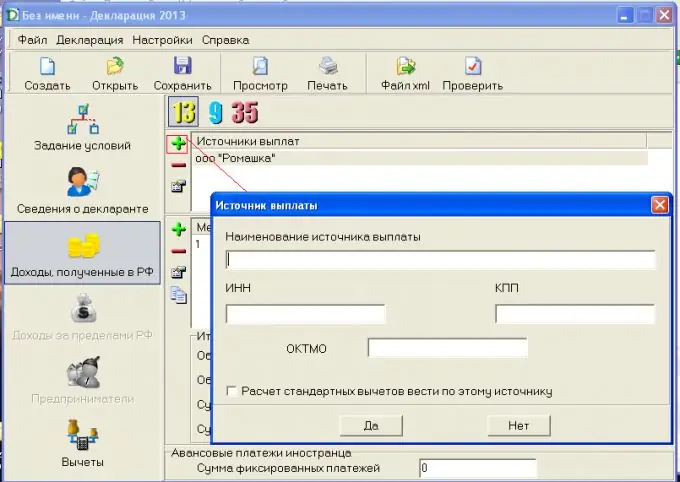

Go to the tab "Income received in the Russian Federation". Next to the "sources of payments" window, click on the "+" sign and fill in the information about the employer (we take the information from the 2 personal income tax certificate).

Step 6

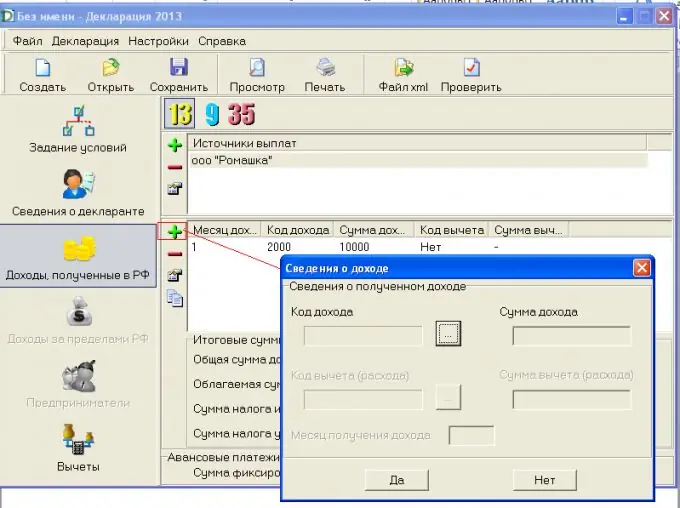

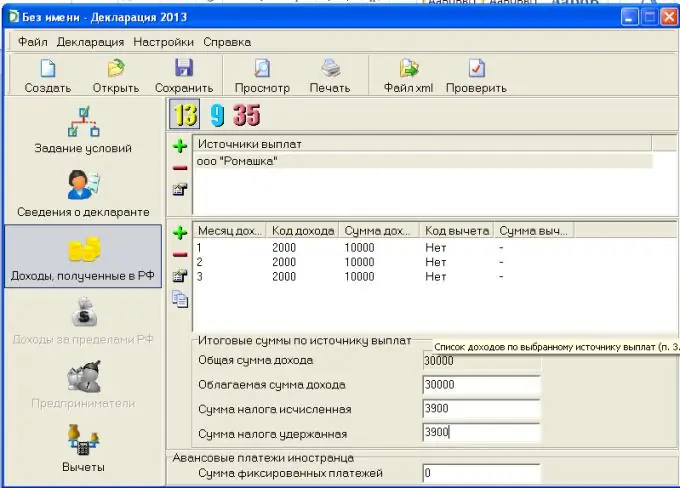

Similarly, we fill in the table with income. Click on "+" and fill in: income code, income amount, deduction code, deduction amount, month of income. We take information from the 2 personal income tax certificate.

Step 7

We fill in the columns under the income table. The total amount of income will be calculated automatically by the program. The taxable amount of income, the amount of tax calculated, the amount of tax withheld - we fill in ourselves (information from certificate 2 of personal income tax).

Step 8

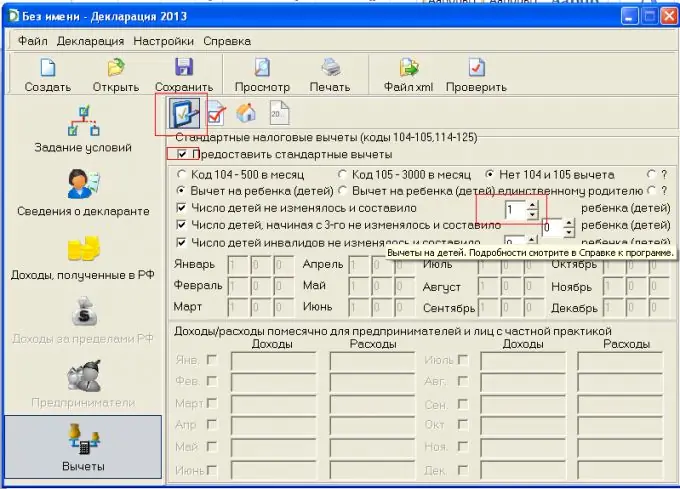

Go to the "Deductions" tab. We put a tick in the box "provide standard tax deductions", indicate which deductions are provided to us (information from the 2 NDFL certificate).

Step 9

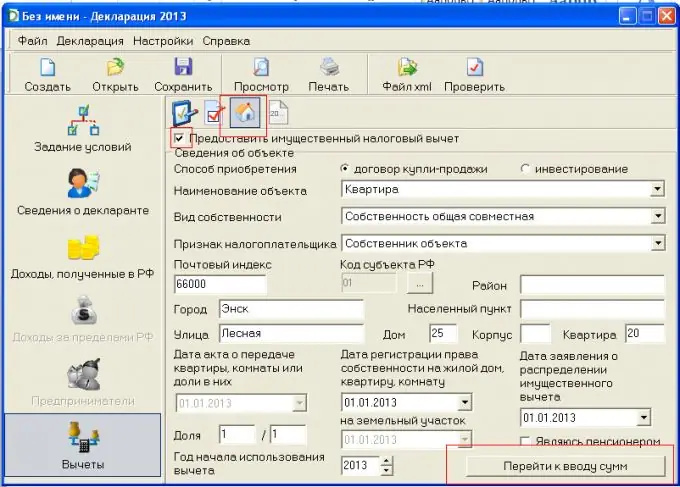

Click on the "house" picture. We fill in the data on the purchased housing. Click on the button "go to entering amounts".

Filling in the type of ownership and the share of the spouses

We look at the certificate of ownership:

- share ownership (shares are clearly defined); - the property deduction is provided in accordance with the share, its size cannot be changed;

- joint ownership. It does not matter who is recorded in the certificate as the owner, if the apartment is purchased in marriage, the property is recognized as joint in accordance with the Family Code of the Russian Federation (Art.33, 34 RF IC). As a general rule, the deduction is distributed in equal shares (50% each), but the spouses have the right to redistribute it in any proportion by submitting an Application for the distribution of shares (in any form) to the tax office.

Step 10

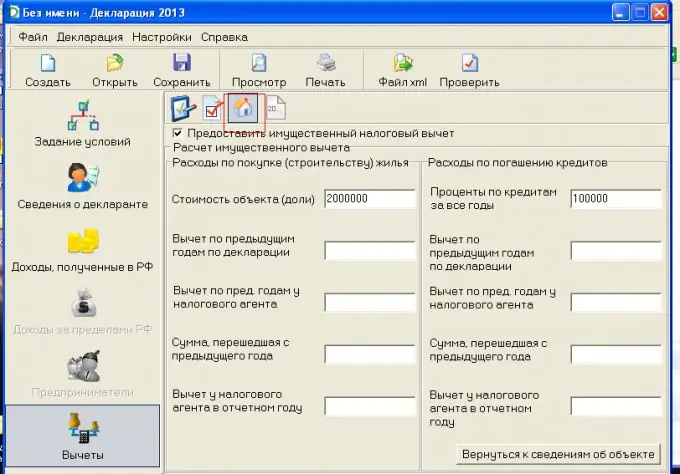

We fill in the amount of expenses for buying a home and repaying a loan.

Property deduction amount.

For housing purchased before January 1, 2014, there is a limitation of the total deduction for a housing object in the amount of 2,000,000 rubles. This means that if you spent more than this amount, you will still receive a deduction of 260,000 rubles (13% of 2,000,000 rubles) and this amount will be distributed between the spouses if the housing is purchased in marriage.

For housing purchased after January 1, 2014, the total deduction is limited to RUB 2,000,000. acts in relation to every citizen. That is, the husband can receive a deduction from 2,000,000 rubles (260,000 rubles), and the wife can receive a deduction from 2,000,000 rubles. (260,000 rubles).

In addition to the deduction for real estate, a citizen is entitled to a deduction for repayment of interest on a loan taken for the purchase (construction) of housing. The loan interest deduction is distributed in the same proportions as the main deduction. That is, if the spouses applied for the distribution of the 75% deduction to the husband and 25% to the wife, then the interest deduction will also be provided in the amount of 75% to the husband and 25% to the wife.

For loans received before 2014, the amount of interest paid on which the state returns 13% of income tax is not limited, for loans received after January 1, 2014, the maximum amount of such expenses is 3,000,000 rubles (that is, you can return a maximum of 390,000 rub.)

Step 11

If you previously filed 3 personal income tax declarations, then we fill in the appropriate columns. Deduction for previous years according to the declaration - we enter the amount for all previously submitted declarations (the amount with which you were refunded personal income tax, and not the amount of the refund). The amount transferred from the previous year is from the last filed declaration. We fill in the expenses for repayment of loans in the same way.

Step 12

Click on the "view" button. We check, print, sign, submit to the tax office with all the necessary documents.

Step 13

Property tax deductions (for the purchase of an apartment and for the payment of interest) can be provided even before the end of the tax period. To do this, you must apply to the tax office to receive a notice of the right to a property deduction with copies of documents confirming this right.

After 30 days, receive a notice of the right to a property deduction from the tax authority and provide it to the employer Based on this document, the employer will not withhold personal income tax, that is, the salary will not be taxed at 13%.