An individual's income statement is required in many circumstances. In particular, for obtaining loans, entering visa countries, receiving benefits and discounts, etc. It is drawn up at the place of work of the person who needs it. The certificate of form 2-NDFL reflects all income, taxes paid. Some banks are ready to provide a loan on a certificate written on the bank's letterhead. This is the case if the borrower receives a black salary, and the official income is very low.

Instructions

Step 1

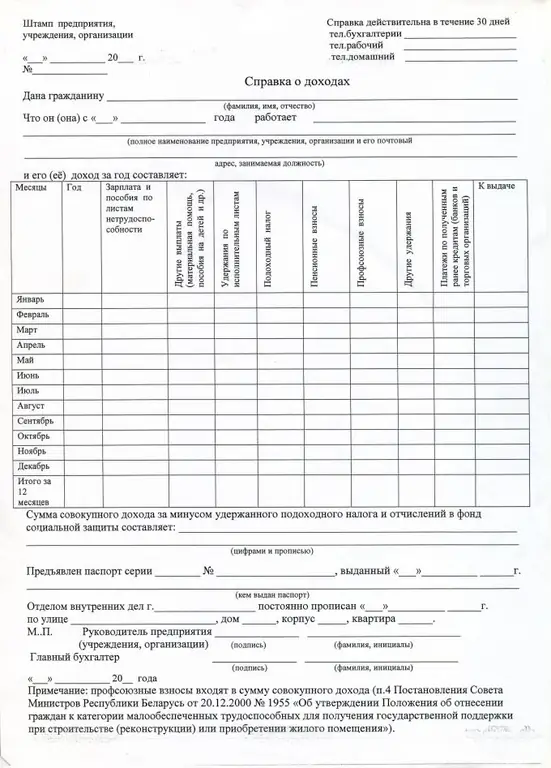

The person responsible for keeping records of income and withholding taxes, that is, the chief accountant of the enterprise or deputy, is obliged to fill out the 2-NDFL certificate. This document is signed by the head. The seal of the organization must be affixed and all TIN information is indicated, the person to whom the certificate is issued and the organization that issued the certificate.

Step 2

Information about income is filled in 6 or 12 months, depending on what the employee needs. The same period is indicated in the calculation of tax contributions.

Step 3

The amounts are written exact, not abbreviated.

Step 4

The exact information about the employee and the organization that issued the certificate is filled in.

Step 5

If an employee works for several employers, then each employer is obliged to fill out Form 2-NDFL.

Step 6

If income is not official and income tax contributions are not paid, the employer will refuse to fill out the official income statement form. In this case, banks issue their own forms for filling.

Step 7

Income is indicated for a period of 6-12 months. Amounts - remaining after tax.

Step 8

All the details of the recipient of the certificate and the organization issuing the certificate are written.

Step 9

The TIN of the employee and the TIN of the organization are also indicated. The seal of the organization that issued the certificate, the resolution of the head and the chief accountant of the enterprise is put.

Step 10

Currently, the media is overwhelmed with announcements for help in obtaining income statements.

Step 11

For fake certificates presented to any authorities, the bearer faces an administrative fine. In addition, do not forget that if you are going to apply for a loan using a fake certificate, the bank's security service first checks the accuracy of the information provided by the borrower and only after that a decision comes whether they will give you a loan or refuse.