On February 14, 2015, a new form of the 3-NDFL tax return was approved. The declaration is required to receive a property tax deduction in connection with the purchase of a home. The easiest way is to fill out the declaration using a special program downloaded from the official website of the tax office.

Necessary

- - computer with Internet access;

- - certificate of income in the form of 2-NDFL for the last year;

- - passport and TIN certificate;

- - certificate of state registration of ownership of an apartment (house);

- - copies of payment documents confirming expenses for the acquisition of property;

- - documents confirming the payment of interest under a target loan agreement or loan agreement, mortgage agreement.

Instructions

Step 1

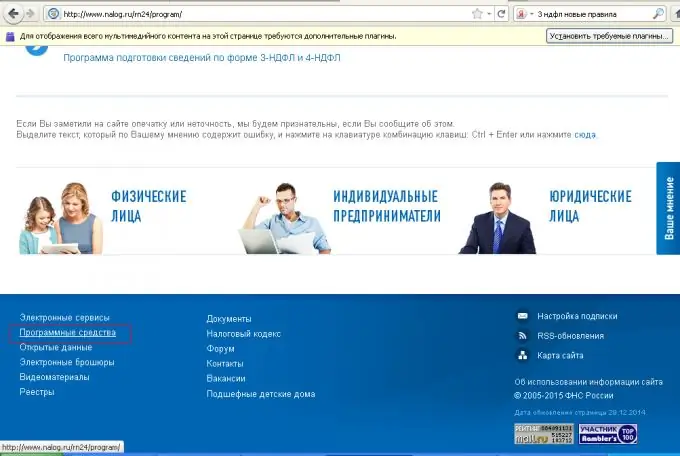

Download and install the Declaration 2014 program from the official website of the Russian tax service. You can find it in the "Software" section, at the very bottom of the start page of the site.

Step 2

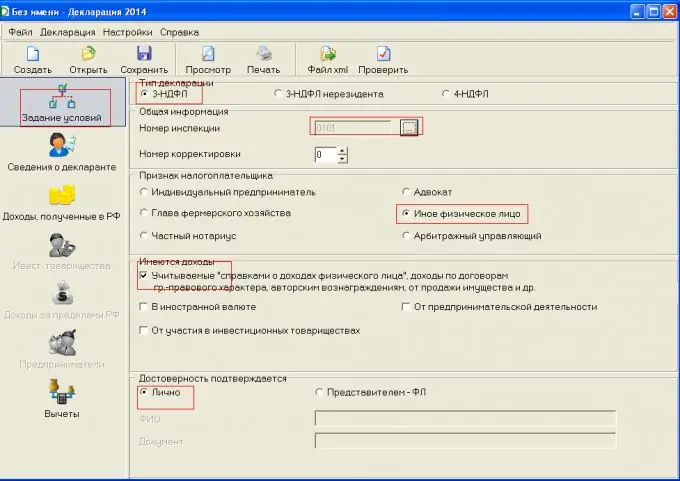

We launch the program. The program opens on the "Specify conditions" tab. We mark the required values.

Step 3

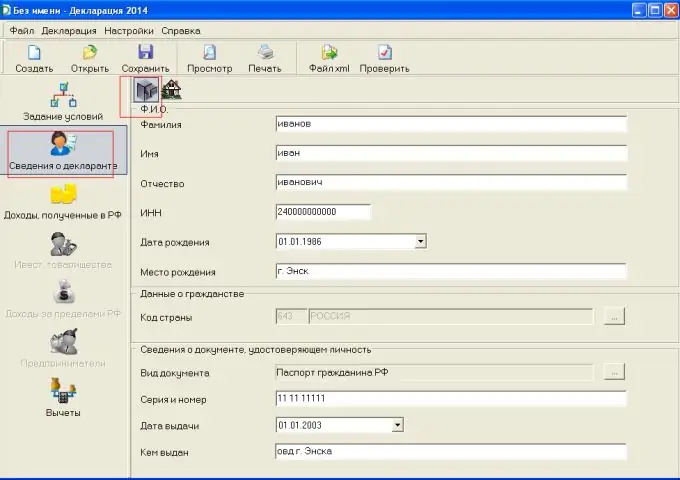

Go to the tab "Information about the declarant". We fill in the passport data.

Step 4

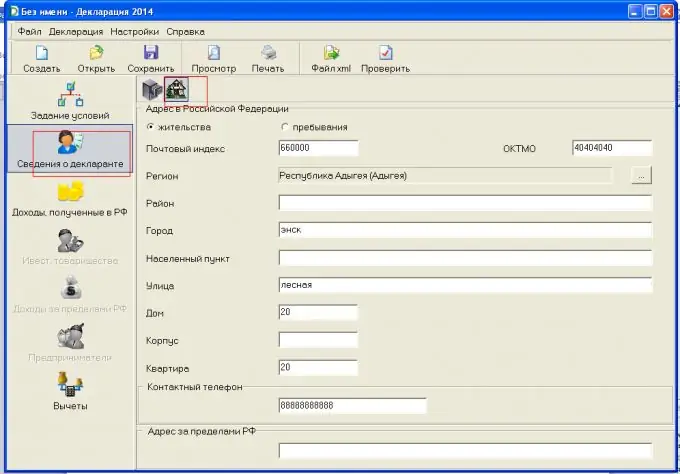

In the same tab, click on the "house" icon and fill in the place of residence, according to the data from the passport. Do not forget to indicate the OKTMO code (you can find it out on the website of the FMS of Russia using the "Learn OKTM" electronic service).

Step 5

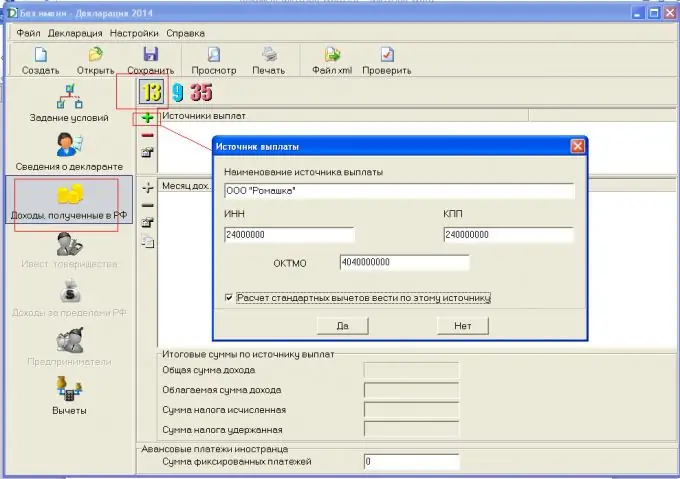

Go to the tab "Income received in the Russian Federation". In the "Sources of payments" tab, click on the "+" icon and fill in the information about your employer (we take the information from the 2 NDFL certificate). If there are several employers, add them by clicking on the "+" sign.

Step 6

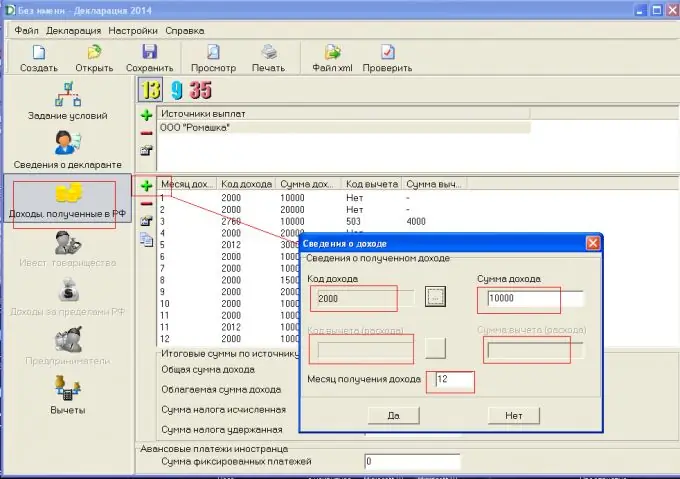

Similarly, we fill in the table with information about income. Click on "+" and enter the data from the 2-NDFL certificate: income code, income amount, deduction code (if any), deduction amount (if any) for each month separately. Each line with income in your certificate, a separate column in the income table in the declaration. If in one month you have several amounts in the 2-NDFL certificate (for example, salary, financial assistance, and vacation pay), we enter each amount separately.

Step 7

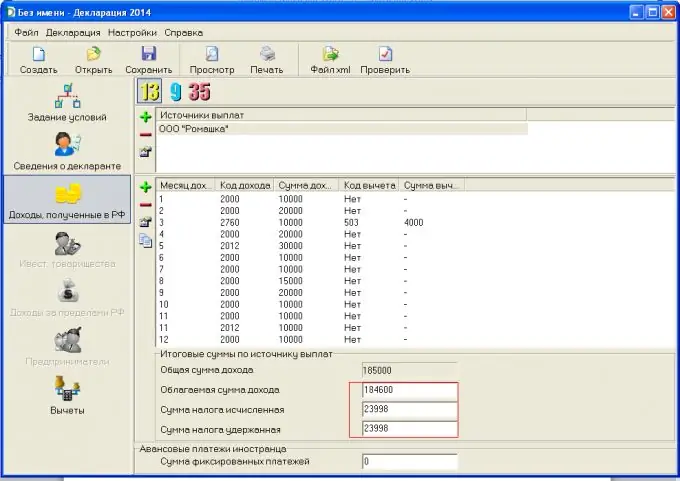

After filling in the table, we enter the data on income in the lower columns. The total amount of income will be calculated automatically, the taxable amount of income, the amount of tax calculated and the amount of tax withheld - we make it ourselves from the 2-NDFL certificate.

Step 8

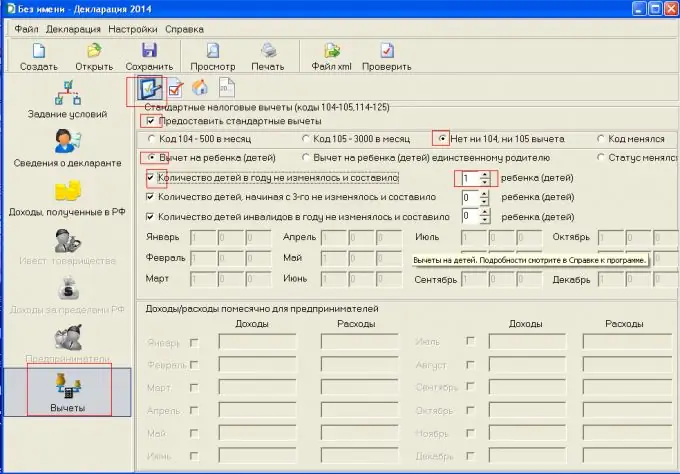

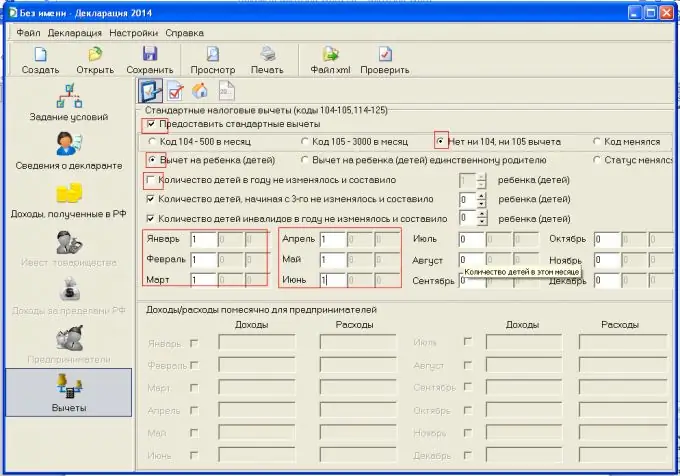

Go to the "Deductions" tab. If you receive standard tax deductions, please tick the appropriate box. Deductions are also reflected in your 2-NDFL certificate. We put down the necessary values.

Step 9

In a situation where the deduction was not provided for the entire year (for example, the child graduated from the institute in June), remove the check mark from the corresponding field and put down the values in the months when the deduction was provided.

Step 10

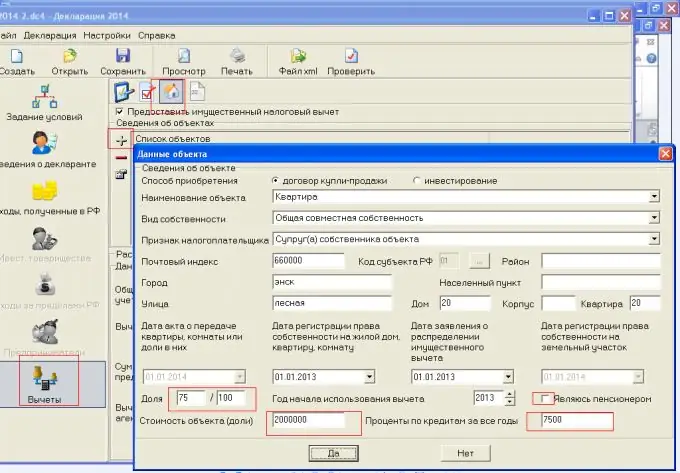

In the same tab, click on the "house" icon. The program prompts you to fill in information about the objects. Click on the "+" icon and fill in the required information. Pay attention to the distribution of shares. Spouses, if the housing is in their common joint ownership, have the right to distribute the deduction in any ratio, the cost of the object is written in full, and the amount of interest is in accordance with the share. That is, if the cost of housing is 2,000,000 (this is the maximum from which you can return personal income tax), the interest for all years is 10,000, and the share of the spouse is determined to be 75%, then we write 2,000,000 in the column for the cost of the object, and 7,500 in the column.

If you receive a deduction from 2014, that is, documents confirming the right to receive a property tax deduction are dated from January 1, 2014, then the "share" box will be inactive and you do not need to fill it out (then we fill in the column for the cost of housing in accordance with the size share).

Step 11

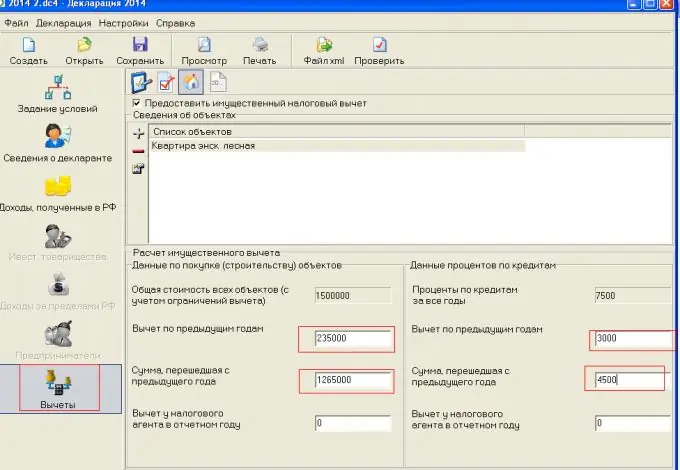

In the same tab, fill in the amount of deductions already received in previous years. If you started using the deduction in 2014, then the boxes for filling in the amounts for previous years will be inactive. If you receive a deduction, for example, as in the example from 2013, then you need to fill in the appropriate columns: deduction for previous years (we write the amount with which personal income tax was calculated last year); the amount transferred from the previous year (you can look in the declaration for the last year, or you can independently subtract from the total amount, in the example it is 1,500,000 rubles the amount from which personal income tax was withheld last year); deduction for previous years and the amount transferred from the previous year in terms of interest (we also look at how much was provided in the previous declaration.

Step 12

We save, review, check, print. We sign and carry to the tax office with the documents: an application for the return of personal income tax with the indication of the details for transferring the refund amounts, a certificate from the accounting department in the form of 2-personal income tax for the corresponding year, copies of documents confirming the right to housing, copies of payment documents confirming expenses for the acquisition of property, documents, testifying to the payment of interest under a target loan agreement or loan agreement, a mortgage agreement, a copy of a marriage certificate (if the housing was acquired in joint ownership), an application for the distribution of the property tax deduction (if the housing was acquired in joint ownership).